Solo 401(k)

Self-Direct Your Solo 401(k). Invest in What You Know.

Take Control of Your Retirement™

Getting started with a Solo 401k

4 Key Points to Consider

When Using a Solo 401(k)

1. Over $60K In Annual Contributions

![]() A solo(k) can receive over $60K annually in new contributions and is an optimal savings tool for self-employed persons.

A solo(k) can receive over $60K annually in new contributions and is an optimal savings tool for self-employed persons.

2. Self-Directed and Self-Trustee

3. Must be Self-Employed with No Employees

4. Roth & Traditional Accounts

Fee Schedule Solo 401k – Custodial

Fee Schedule Solo 401k – Annual Compliance Plan

Solo 401k Participant Loan Request

Set Up a FREE Appointment with a Solo 401(k) Specialist

With Ryan Hyde for a 30-minute Quick Start Call to set up a new Solo 401(k)

With Solana Raybon for a 30-minute Quick Start Call to set up a new Solo 401(k)

Schedule with Markus Mollica for a New Account Call to set up a Self-Directed IRA.

Schedule with Brian Martinez for a New Account Call to set up a Self-Directed IRA.

Do You Qualify For a Solo 401k?

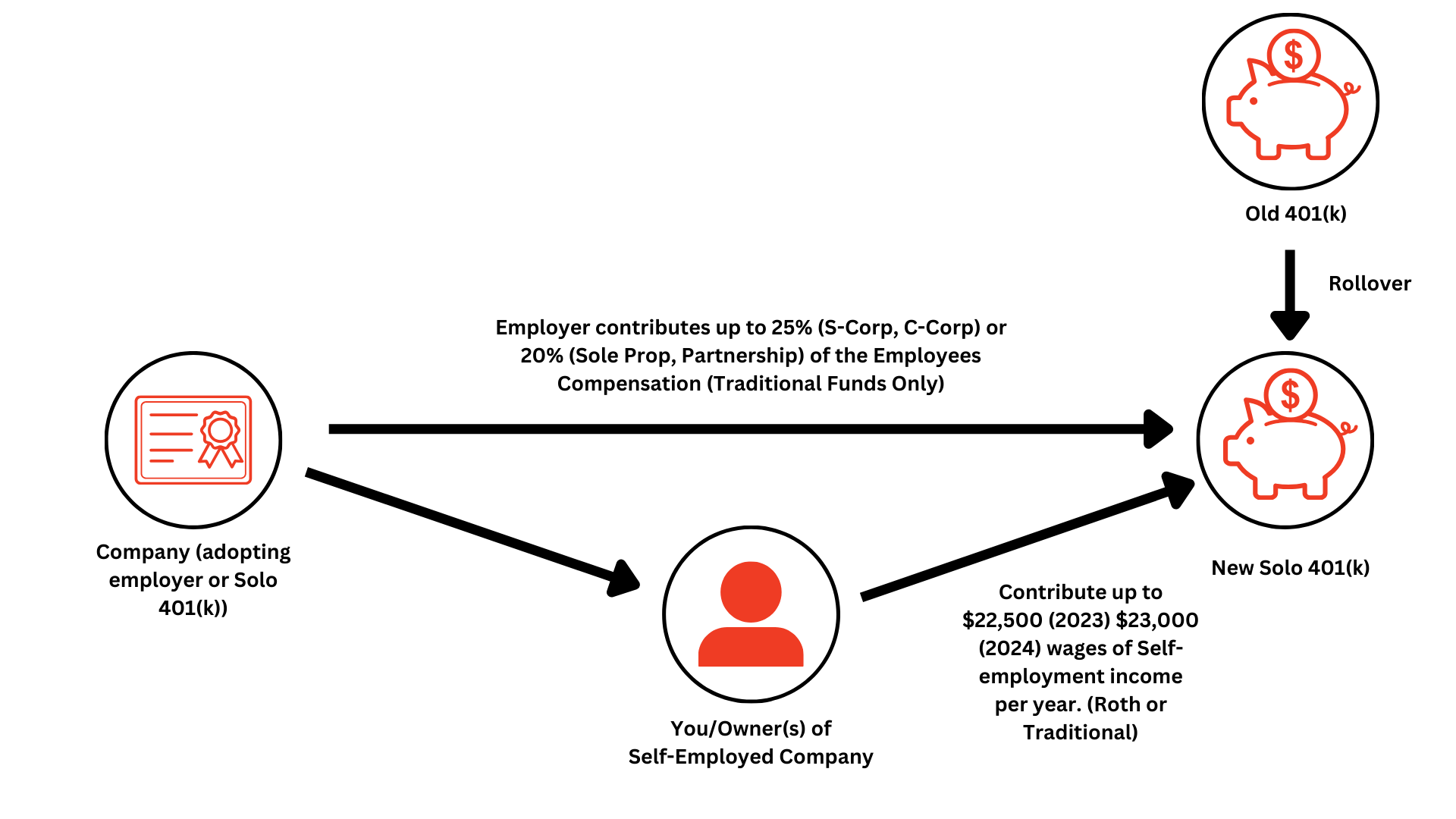

Solo 401(k) Account: (Can be both Roth and Traditional or Both) Opening Solo 401(k) Next Steps: The Solo 401(k) is an Employee Benefit Plan that is exclusively for business owners that have no full-time employees besides themselves and a spouse. The Plan is adopted by a company, not an individual, that has earned ordinary income from the sale of goods or services.

Step 1: Select the plan that works best for you

Full Service – $995

- Includes 60-minute consultation with a KKOS Associate Attorney

- Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

Docs Only – $495

- Includes Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

Restatement – $495

- Includes Plan Set-Up with IRS Approved Documents and Plan EIN (as necessary)

- How-to Plan Binder

Step 2: Select your annual account

Custodial Account Option

$395 per account

- Receipt of IRS Plan Amendments so that your plan stays in compliance with the IRS and the DOL

- Directed Trust Company will handle your record keeping and the IRS Filings (5500-EZs & 1099-Rs)

- You can obtain checkbook control via a Trust Checking Account or Investment Entity

Annual Compliance Plan (ACP)

$150/annually

- Receipt of IRS Plan Amendments so that your Plan stays in compliance with the IRS and the DOL

- Immediate checkbook control via a Trust Account at a bank of your choice

- You will be responsible for your own record keeping and IRS Filings

Opening Solo 401(k) Next Steps:

The Application is for a plan set-up with Kyler Kohler Ostermiller & Sorensen, LLP (“KKOS”) who is a separate law firm and who has an IRS pre-approved Solo 401(k) that can be self-directed.

Solo 401(k) Plan Application

Solo 401(k) FAQ Sheet

Learn more about a Solo 401k

What Account Type is Best?

Please use the table and resources below to help compare

between a Solo 401(k) or a Self-Directed IRA

|

SOLO 401(k) |

SELF-DIRECTED IRA |

|

|---|---|---|

|

Qualification |

Must be self-employed with no Full-Time Employees (besides yourself and a spouse). |

Self-Employment not required – must have earned income to contribute. |

|

Contribution Limits |

Max Annual Contribution = $66,000 (2023) |

Max Annual Contribution = $6,500 ($7,500 if over 50). |

|

Custodian Requirement |

You can be the Trustee and Administrator – No Custodian required but one may be named |

You MUST have a 3rd Party Custodian. |

|

Rollover Limitations |

Can rollover most retirement accounts except Roth IRA and 401k with a current employer. |

Can rollover existing retirement accounts. |

|

Loans |

Can borrow up to $50,000.00 from the 401(k) it is called a Participant Loan**. |

Cannot borrow from the IRA. |

|

UDFI Tax |

Leveraged Real Estate is NOT subject to UDFI. |

Leveraged Real Estate IS subject to UDFI Tax. |

|

Consequence of Prohibited Transaction |

15% excise tax if prohibited transaction occurs. |

Entire IRA is distributed if Prohibited Transaction occurs. |

Annual Maintenance Options

Choose the pricing plan

that best fits your personal situation

|

ANNUAL COMPLIANCE PLAN |

FULL SERVICE CUSTODIAL |

|

|---|---|---|

|

Trustee/Plan Administrator |

Client is Trustee and Plan Administrator. |

Client is Trustee and Plan Administrator. |

|

Custodian |

No Custodian is named. |

Directed Trust Company named as Custodian. |

|

Bank Account Option |

Client goes to a bank of their choice to set-up a Trust Checking Account. |

Transactions will be made through an account held with Directed Trust Company. |

|

Checkbook Control |

Client has immediate checkbook control through their Trust Checking Account. |

Client can have a bank account for checkbook control funded from your Custodial Account. |

|

Record Keeping Responsibilities |

Client is responsible for all record-keeping and IRS filings required of the plan (ie. 5500 EZ or 1099-R**) |

Directed Trust Company handles all recordkeeping and IRS filings required of the plan. |

|

Annual Fee |

$150.00 Annually |

$395 for the first account under the plan, $295 for subsequent accounts |

VIDEOS AND ARTICLES ON SOLO 401(K) ACCOUNTS:

Definitions, Deadlines

and Funding Options

|

5500 EZ |

The administrator of the plan is required to file form 5500 EZ with the IRS if their Solo 401(k) plan has a combined value of assets over $250,000. For plans on a calendar year, the deadline for this filing is July 31st. |

|

1099-R |

Issued anytime money leaves a retirement plan (account) or if a Roth Conversion occurs. The deadline for this filing is January 31st. |

|

Participant |

A Loan that allows account holders to take a loan up to $50,000.00 or 50% of available plan balance. Interest Rate is Prime +2%. The loan must be paid within 5 years and payments must be made at least quarterly. |

|

New Solo 401(k) Set-Up Deadline |

The Solo 401(k) Plan must be established by the Adopting Entity’s Tax Deadline. |

|

Employee Contribution Reporting Deadline |

You must report your Employee Contributions via W-2, which is due January 31st, but you have until the company’s tax return is filed to make the contributions. |

|

Contribution Deadline for Sole Prop, Single-Member LLC, or C-Corp |

April 15th (Can be extended by filing an extension) |

|

Contribution Deadline for S-Corp or Partnership LLC |

March 15th (Can be extended by filing an extension) |

FUNDING VIA CONTRIBUTIONS OR ROLLOVERS

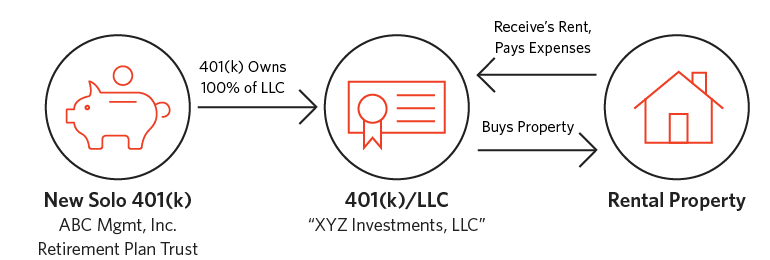

401(K)/LLC

Articles On How To

Self-Direct Your Solo 401(k)

2023 Solo 401(k) Contribution Deadlines: Rules, Steps, and Strategies

As we near the close of 2023, embark on a journey of financial empowerment! For Solo 401(k) owners, understanding the exciting deadlines and regulations that shape your contributions is key..

Self-Directed IRA Versus Solo 401(k)

Many self-directed investors have the option of choosing between a self-directed IRA or a self-directed solo 401k….

Solo K Form 5500 Tax Filing and Five-Point Compliance Checklist

Solo 401(k)s have become a popular retirement plan option for self-employed persons….