Directed IRA Articles

The #1 resource on self-directing your

IRA. Take control of your retirement™

Most Popular

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

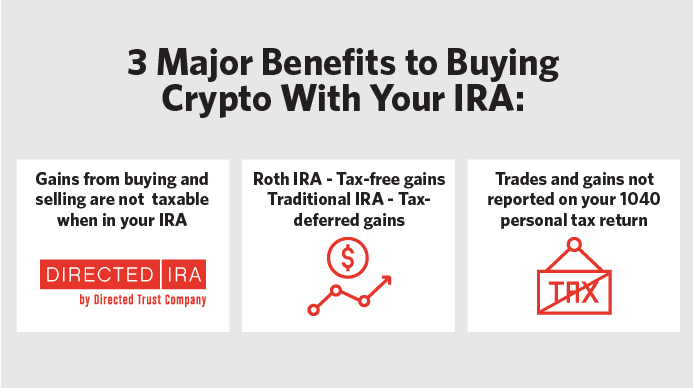

Buying Cryptocurrency With Your IRA

Avoid taxes and the headache of reporting to the IRS by buying crypto with your IRA. There are 3 major benefits to buying Crypto with your IRA: The gains from buying and selling crypto are not taxable when done in your IRA. Similar to buying and selling stock in your...

Contribution Deadline for IRAs and More Changed to May 17th

What is the last day to contribute to an IRA for 2020? Taxpayers now have until May 17, 2021, to contribute to their Individual Retirement Accounts (IRAs), Health Savings Accounts (HSAs), and Coverdell Education Savings Accounts (ESAs), according to a statement by the...

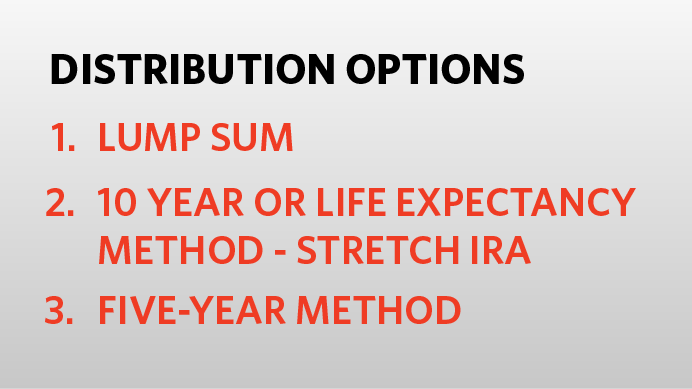

Inherited IRAs: Requirements and Tips

If you’ve inherited an IRA from a parent or another loved one, it is likely that you have an Inherited IRA (aka, Beneficiary IRA). These can be powerful accounts, but you need to understand the Required Minimum Distribution (“RMD”) rules for your Inherited IRA to...

Managing a Rental Property Owned by Your Self-Directed IRA

When IRA-owned property is held for rent, the management of the rental property must be structured such that rental income is received by the IRA and expenses are paid by the IRA. The IRA owner and other disqualified persons (e.g. IRA owner, spouse, etc.) cannot...

College Savings Account: Coverdell Education Savings Account (CESA) vs. 529 Plan

COVERDELL ESA Kids are going back to school after the break and it’s a great time to think about college and to make financial plans for your children or grandchildren’s education. As you consider the different plan options, you’ll want to make sure you know the two...

Can I Use a SEP IRA If I Have Employees?

A SEP IRA is a powerful retirement account used by many self-employed persons and business owners. It is particularly attractive as you can contribute up to $58,000 to it annually. That’s in comparison to a Traditional IRA, where you can only contribute up to $6,000 a...

Three Unique Benefits of Health Savings Accounts You Never Knew

HSAs (“Health Savings Accounts”) are growing in popularity as Americans are discovering significant tax savings with these accounts. Why are they popular? There are many reasons why; some well known and others not so well known. Let’s start with the primary benefits...

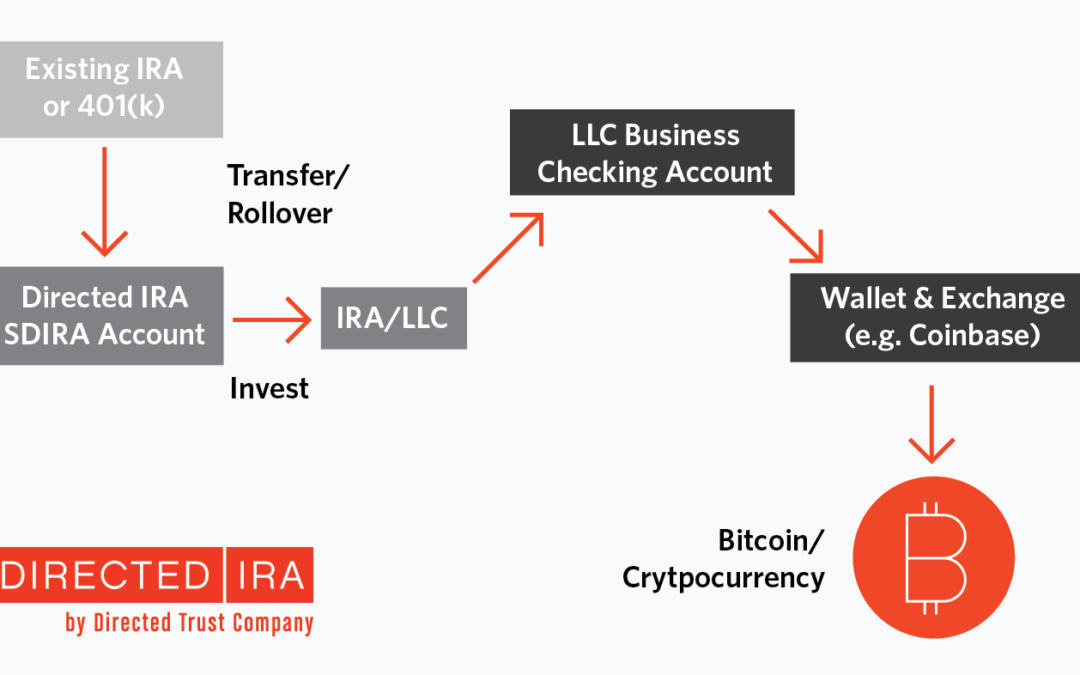

Using the IRA/LLC option to own Bitcoin and other Cryptocurrency

As the price of Bitcoin (BTC) has surpassed $50,000, we have seen increased interest in using IRA and other retirement plan funds to own Bitcoin and other cryptocurrencies. But can your IRA, Roth IRA, solo(k), or other retirement account own Cryptocurrency? Yes, your...

Can My IRA/LLC Have a Brokerage Trading Account?

Many self-directed IRA investors use an IRA/LLC to make and hold their self-directed IRA investments. In essence, an IRA/LLC (aka “checkbook-controlled IRA”) is an LLC owned 100% by an IRA. For a summary and description of an IRA/LLC, please refer to my video here....

Roth Conversions: When Should You Convert Your IRA or 401(k) to Roth?

https://www.youtube.com/watch?v=9uOLoWUw6qk Roth conversions remain popular as many fear that tax rates will only increase in the next few years, so why not convert now at lower tax rates and let the account grow and come out tax-free at retirement. Remember, if you...

Subscribe to our Newsletter

Be the first to know when we release our latest articles, podcasts and videos

Most Popular

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.