Avoid taxes and the headache of reporting to the IRS by buying crypto with your IRA.

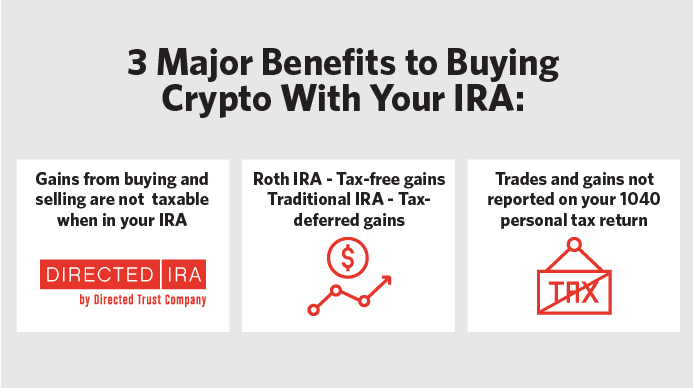

There are 3 major benefits to buying Crypto with your IRA:

- The gains from buying and selling crypto are not taxable when done in your IRA. Similar to buying and selling stock in your IRA, there is no tax due when you buy crypto in your IRA and later sell it for profit. It grows tax-deferred in a traditional IRA and comes out tax-free in a Roth IRA. Your gains can fully compound and grow without having to pay the IRS every year.

- The crypto gains come out tax-free at retirement in a Roth IRA and are tax-deferred when distributed at retirement in a Traditional IRA.

- Your IRA trades and gains from crypto trading in your IRA does not show up on your 1040 personal tax return with the IRS.

Directed IRA offers Roth IRAs, Traditional IRAs, SEP IRAs, and 6 other account types which you can use to buy and sell crypto in your retirement account through our institutional relationship with Gemini where you can buy 40 plus crypto coins including Bitcoin, Ethereum, and Doge.

To learn more about the different account options visit our Crypto page. And learn more about tax planning for bitcoin and other cryptocurrency profits.