As the price of Bitcoin (BTC) has surpassed $50,000, we have seen increased interest in using IRA and other retirement plan funds to own Bitcoin and other cryptocurrencies. But can your IRA, Roth IRA, solo(k), or other retirement account own Cryptocurrency? Yes, your IRA can invest in and own bitcoin and other cryptocurrencies. Bitcoin is a form of virtual currency using blockchain technology and can be exchanged between parties for goods and services, or for dollars. When I wrote my first article on this topic and recorded the video on how it works I noted that from 2011 to July 2017, the value of Bitcoin has risen from $0.30 per Bitcoin to $2,550 per Bitcoin. It has recently surpassed $50,000 per Bitcoin. As investment interest and values have increased, we’ve been fielding questions from investors about whether their retirement account can invest in and own actual Bitcoin or other forms of cryptocurrency.

Can Your IRA Own Bitcoin or Other Cryptocurrency?

Well, the short answer is: “Yes, your IRA can own Bitcoin and other forms of cryptocurrencies, such as Ethereum and Litecoin.” The only items an IRA cannot invest in is life insurance, S-Corp stock, and collectibles as mentioned in IRC 408(m), which refers to tangible personal property such as “art, rugs, coins, etc.” and “any other tangible personal property the Secretary determines.” Bitcoin is certainly an intangible item by all accounts and would not be considered tangible. As a result, an IRA can own Bitcoin or other cryptocurrencies since such investments are not restricted.

How Are Bitcoin Gains Taxed?

The IRS issued IRS Notice 2014-21 addressing the taxation of Bitcoin and cryptocurrency and stated that Bitcoin and other forms of virtual currency are property. The sale of property by an IRA is generally treated as capital gain, so the buying and selling of cryptocurrency for investment purposes wouldn’t trigger unrelated business income tax (UBIT) or other adverse tax consequences that can occasionally arise in an IRA.

How Do I Own Bitcoin with My SDIRA?

There are three steps to own Bitcoin or other cryptocurrencies with your IRA:

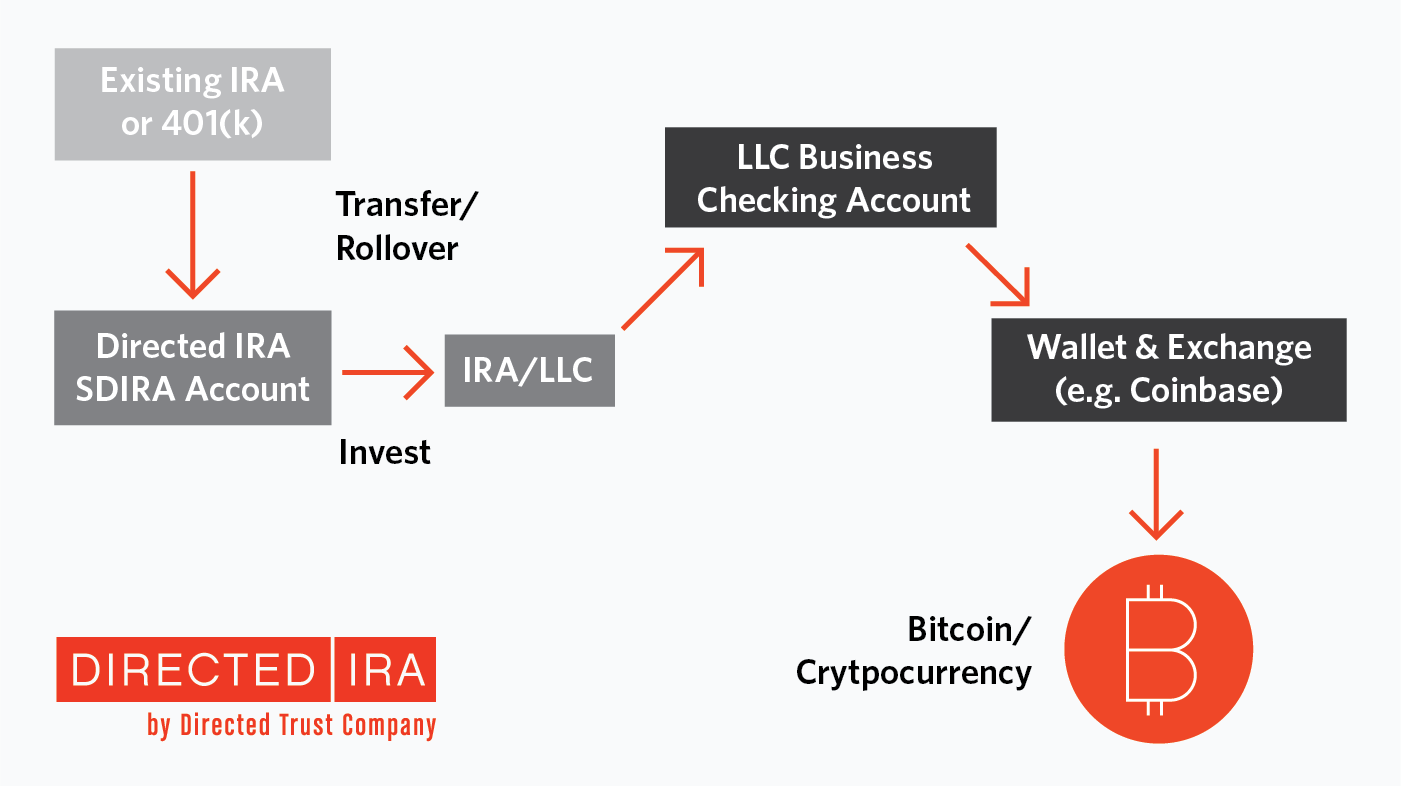

1. First, you will need a self-directed IRA or an account with a custodian who allows for alternative assets, such as LLCs. Our company, Directed IRA and Directed Trust Company, has worked with thousands of self-directed investors and can establish your self-directed IRA, Roth IRA, or solo(k) account that can be used to invest in cryptocurrency.

2. Second, you will invest funds from the IRA into the LLC. Your IRA will own an LLC 100%, and that LLC will have a business checking account. For more details on IRA/LLCs, please check out my prior video here.

3. Third, the IRA/LLC will use its LLC business checking account to establish a wallet to invest and own Bitcoin or other cryptos through the wallet. The most widely used Bitcoin wallet is through a company called Coinbase, and you can use your wallet on Coinbase to buy, sell, and digitally store your cryptocurrency. Other popular sites and exchanges include Binance, Kraken, and Bittrex. The wallet is the method used to store the cryptocurrency keys that are used to transfer the cryptocurrency. You can use off-line hardware wallets that the IRA/LLC purchases or you can wallets that are based on-line such as Coinbase.

There are already certain publicly-traded funds and other avenues (e.g. Bitcoin Investments Trust) where you can own shares of a fund that in turn owns Bitcoin. But, if you want to own Bitcoin directly with your IRA, you’d need to follow the steps outlined above. There are also companies who will own Bitcoin and other Cryptocurrency directly in your account without the need for an LLC. This option has two drawbacks investors should be aware of. First, the IRA custodian will have the keys to the cryptocurrency. These keys are the actual items you must have to transfer or sell the crypto to someone else. If the keys are lost, so is the crypto. It would be like losing possession of the cash. When you use an IRA/LLC, you have and hold the keys to the cryptocurrency. This puts you, the investor, in greater control and is why we have used the IRA/LLC structure to help self-directed IRA account holders own Cryptocurrency.

Keep in mind, Bitcoin and other forms of cryptocurrency have significant potential in the digital age. However, as with any new market investment, make sure you proceed with caution and don’t “bet the farm” or “go all-in” on just one investment or deal. There have been repeated cases of digital fraud and loss of keys that have been devastating for investors so make sure you are working with reputable companies and sites when investing in Cryptocurrency with your IRA.