Crypto IRA by Directed IRA

We simplified the process so your IRA can invest directly in Bitcoin and other Cryptocurrencies without using an IRA/LLC.

Open Crypto

IRA & Fund

Your Account

Directed IRA using forms below

money to

trading account

at Gemini

Gemini trading account

& hold

Crypto

Assets

trading

account

at Gemini

Bitcoin & 60+

More Crypto

on Gemini

Directed IRA using forms below

Gemini trading account

currently offered on Gemini.

WEBINAR: Step by Step Overview of Investing your IRA in Bitcoin and other Crypto.

PODCAST: How to Invest in Bitcoin and other Crypto with a Self-Directed IRA or 401k

Fee Schedule

What are the fees for a Crypto IRA?

The Crypto IRA fees consist of an Annual Account Fee charged by Directed IRA of $295, a 0.50% (50 basis points) per trade fee, and a one-time new account establishment fee of $50.

Directed IRA Annual

Account Fee

$295

Directed IRA

Trading Fee

0.50% (50 basis points) per trade

Fee Schedule: Cryptocurrency

Crypto Accounts by Directed IRA

Traditional IRA, Roth IRA, HSA, ESA, SEP or Solo 401k

If you want to complete and submit a paper application form please Click Here to access a PDF version.

If you need assistance with any of these forms please call 602.899.9396 and a member of our New Accounts team will assist you. Monday-Friday, 8:00 am – 5:00 pm Arizona Time.

If you want to complete and submit a paper application form please Click Here to access a PDF version.

If you need assistance with any of these forms please call 602.899.9396 and a member of our New Accounts team will assist you. Monday-Friday, 8:00 am – 5:00 pm Arizona Time.

Easy Online Account Setup to Buy Bitcoin and Other Crypto With a Self-Directed IRA

Step 1

Open Crypto IRA account with Directed IRA. Sign account agreement and provide

government ID (such as driver’s license or passport)

Step 2

Transfer or rollover existing retirement account funds or make a new contribution

Step 3

As part of your Crypto account application you will authorize us to setup a Gemini

trading account for your IRA. You will also authorize the initial investment amount

from your Directed IRA account to fund your Gemini trading account.

Step 4

You will receive an email from Gemini with login and onboarding instructions to access and use your Gemini crypto trading account where you can buy Bitcoin, Ether, Litecoin, and 50+ other Cryptocurrencies. This must be a unique email that is not already used with a personal Gemini account.

Step 5

You will trade and store your cryptocurrency with your IRA owned Gemini account

for your new Crypto IRA

Cryptocurrency FAQs

What Fees Does Gemini Charge?

Up to 0.50% (50 basis points), which is Gemini’s special discounted ActiveTrader™ fee schedule. These fees are charged at the Gemini account level. A $10,000 trade would be subject to a fee at Gemini up to $20.00 under the current Gemini ActiveTrader™ fee schedule. If you trade on the mobile app or Basic trade interfaces with Gemini, this will result in higher fees per trade. The Gemini account fee schedules are subject to change by Gemini.

Are there storage fees?

There is no additional fee to store your crypto on the Gemini exchange.

What Cryptocurrency can I buy?

Bitcoin, Ethereum, and 50+ additional cryptocurrency as listed on the Gemini Exchange with new ones being added constantly. Click here to view full list of eligible crypto at Gemini.

I already have an account at Directed IRA with other

Self-Directed assets, can I trade crypto directly

with this account?

No. Crypto IRAs have a different system, compliance, and procedural processes. A separate Crypto IRA must be established at Directed to link to a Gemini crypto trading account.

Can I do other Self-Directed investments with my Crypto IRA?

No. But, you can easily transfer cash from your Crypto IRA at Directed to your Self-Directed IRA at Directed where you can make other Self-Directed investments.

Can You Explain the Fees for a New Account Buying

$10,000 in Crypto as an Example?

Your Crypto account will be subject to the following fees:

- 0.50% Trade Processing Fee on $10,000 in trades is $50

- The trade fee of 0.50% is inclusive of Gemini’s ActiveTrader fee schedule and Directed IRA.

Total = $50

How are cryptocurrency gains taxed?

The IRS issued IRS Notice 2014-21 addressing the taxation of Bitcoin and

cryptocurrency and stated that Bitcoin and other forms of virtual currency are

property. The sale of property by an IRA is generally treated as capital gain, so the

buying and selling of cryptocurrency for investment purposes wouldn’t trigger

unrelated business income tax (UBIT) or other adverse tax consequences that can

occasionally arise in an IRA.

How are my cryptocurrencies insured?

Cryptocurrencies in your Gemini account will be insured by Gemini’s insurance. You can learn more about their insurance on their website here. There is no FDIC insurance and no guarantees. Crypto is an investment subject to loss of the entire principal amount.

Do I have access to my private keys?

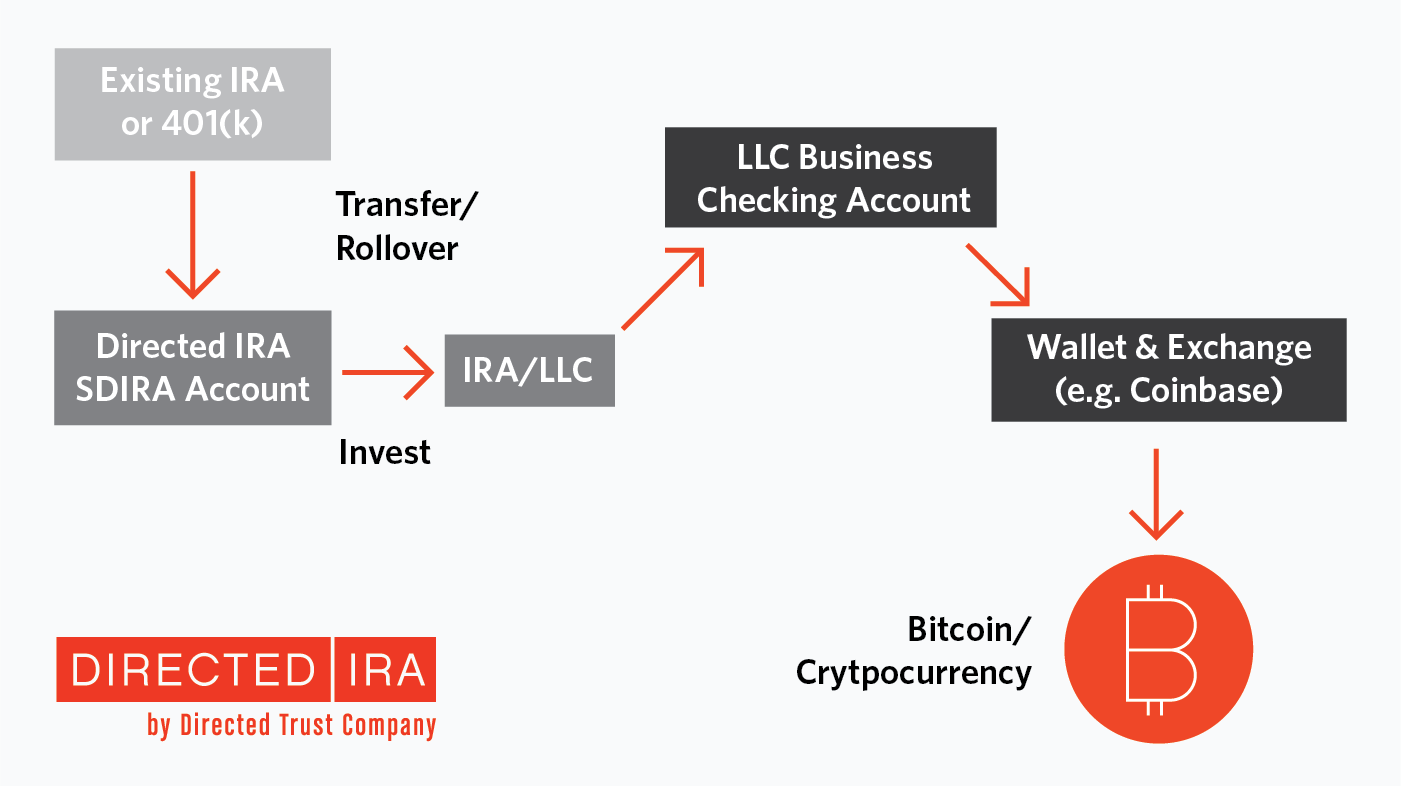

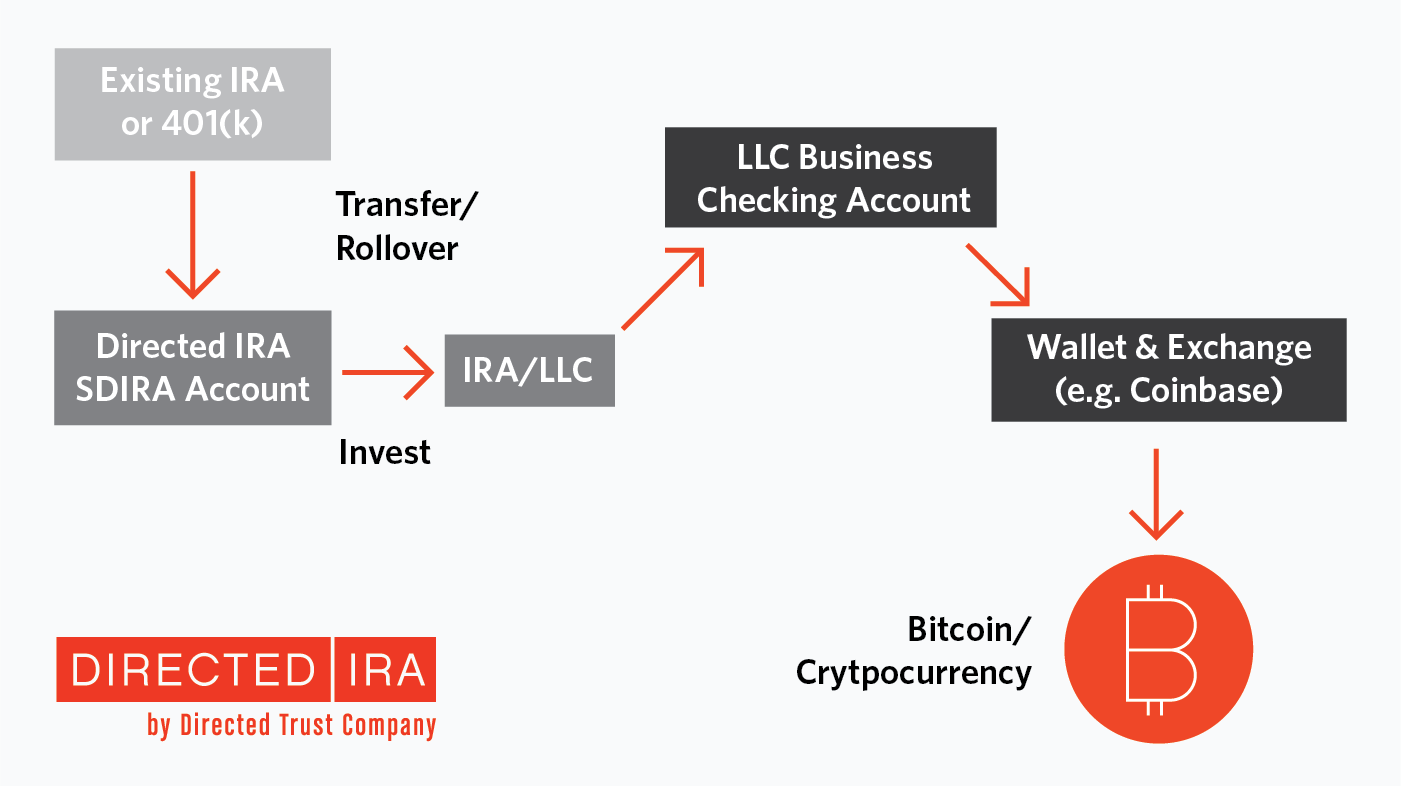

No. At this time you cannot have access to your own keys. If this is something you

want then you’ll need to use the IRA/LLC structure instead. You can learn more

about this process here.

How long does it take after I’ve funded my account

at Directed IRA before I can start trading?

Once you’ve funded your Crypto IRA, Directed will send your funds to your Gemini

account where you’ll have full control and responsibility to make trades. The

standard processing time is 3 business days after your Crypto IRA has been funded.

Can I Purchase Cryptocurrency Not Listed On the

Gemini Exchange?

No. If this is something you want then you’ll need to use the IRA/LLC structure

instead. You can learn more about this process here.

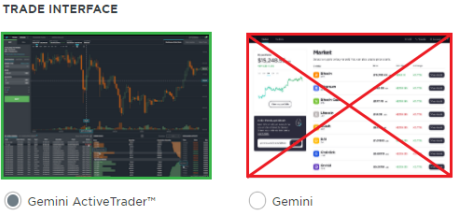

Which Gemini Exchange Trade Interface Do I Use?

The ActiveTrader™ Advanced interface. Please note this interface is only available on the desktop or mobile browser (not the Gemini mobile app). Your Gemini trading fees will be much higher (up to and above 1.5%) if you use the Gemini Mobile app or the Basic Gemini trade interface. Please ensure you are in Gemini’s ActiveTrader™ Advanced interface to get their preferred pricing. If you move to the Basic Gemini interface or use the Gemini Mobile app you will be charged higher fees by Gemini.

Crypto IRA/LLC Structure

For those who want to hold their crypto private keys, buy alternative crypto not available on the

Gemini Exchange, or who want to use other wallets or trade other types of crypto.

Articles on How to Invest in

Cryptocurrency With an IRA

Buying Crypto with an IRA

By using a Roth IRA, an investor can purchase and sell crypto tax-free…

Using the IRA/LLC option to own Bitcoin and other Cryptocurrency

As the price of Bitcoin (BTC) has surpassed $50,000, we have seen increased interest in using IRA and other retirement plan funds…

Tax Planning for Bitcoin and Other Cryptocurrency Profits

Bitcoin, Ethereum, Litecoin, and other cryptocurrencies have seen dramatic price increases this year….

Crypto Mining in Your IRA and UBIT Tax

Crypto mining in your IRA, 401k, or other retirement plans will be subject to unrelated business income tax (UBIT, aka UBTI)…

Crypto Investing With an IRA – Beyond the Basics

Bitcoin, Ethereum, Litecoin, and other cryptocurrencies have seen dramatic price increases this year….