Welcome to the

Directed IRA Learn Page

The #1 education source on self-directing your

IRAs and take control of your retirement™

Podcast

A show dedicated to educating and informing self-directed IRA and 401(k) investors on strategies, investments, legal structures, tax rules, and pitfalls. Hosted by tax lawyers Mat Sorensen and Mark Kohler who are also co-founders of Directed IRA & Directed Trust Company.

Articles

Videos

FREE Quick Start Guides

Latest

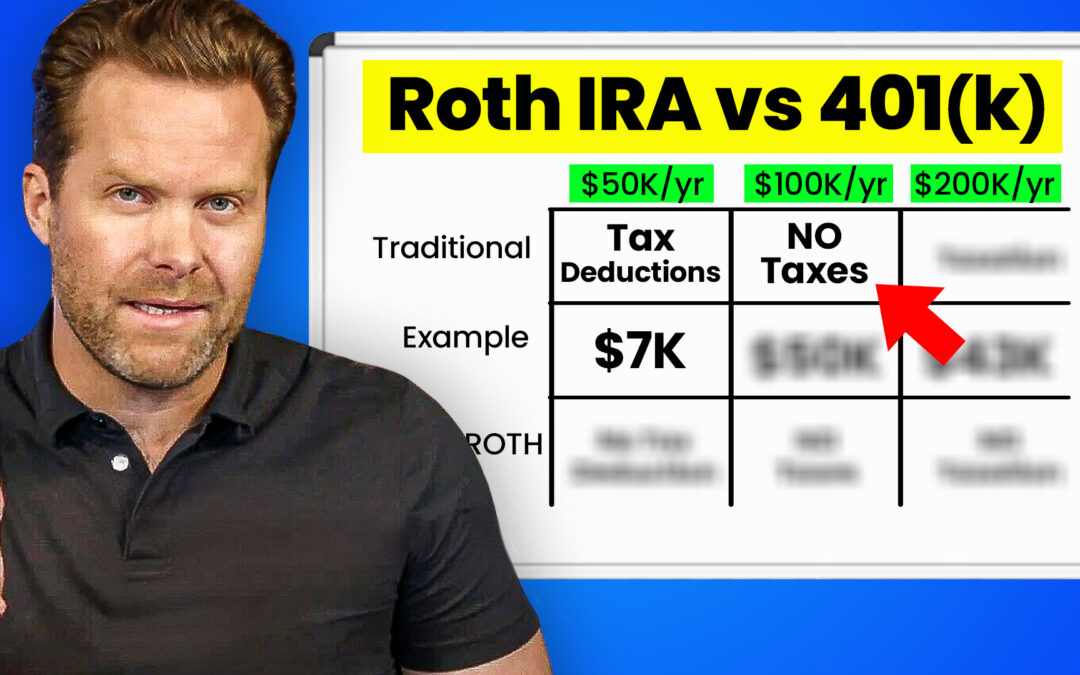

Ep.138 – Roth IRA vs 401(k)…where should You INVEST based on Your Salary Range

Discover the best investment strategy for your salary range in this detailed comparison of Roth IRA vs 401(k). Learn how to maximize benefits with free money matches, understand Solo 401(k)s, and make informed decisions about IRAs. Watch for essential retirement savings tips and get your Free Retirement Accounts Guide!

Ep.137 – My 2024 Roth Conversion: Why I Ignored the Calculators

Discover why Roth conversion is essential for long-term investments in our latest podcast episode. Learn why ignoring the calculators can benefit your 20 or 30-year investment strategy. Tune in now!

Ep.136 – The Complete Guide to Self-Directed IRAs: Top 10 FAQs Answered

In this episode, we tackle the top ten most frequently asked questions about self-directed IRAs. If you’re curious about investing your IRA in assets like real estate, private companies, crypto startups, or private funds, this episode is for you.

Backdoor Roth IRA Strategy

Discover how high-income earners can leverage the Backdoor Roth IRA strategy to enjoy tax-free retirement income. Learn the step-by-step process, benefits, and how to get started with this powerful tax loophole today.