Welcome to the

Directed IRA Podcast

The #1 podcast on self-directing your

IRAs and taking control of your retirement™

Directed IRA Podcast Overview

Join our hosts, seasoned tax lawyers Mat Sorensen and Mark Kohler, co-founders of Directed IRA & Directed Trust Company, as they navigate the intricate landscape of strategies, investments, legal structures, tax rules, and potential pitfalls for investors in the realm of self-directed retirement accounts.

What is a Self-Directed IRA?

Getting Started (Episode 1:)

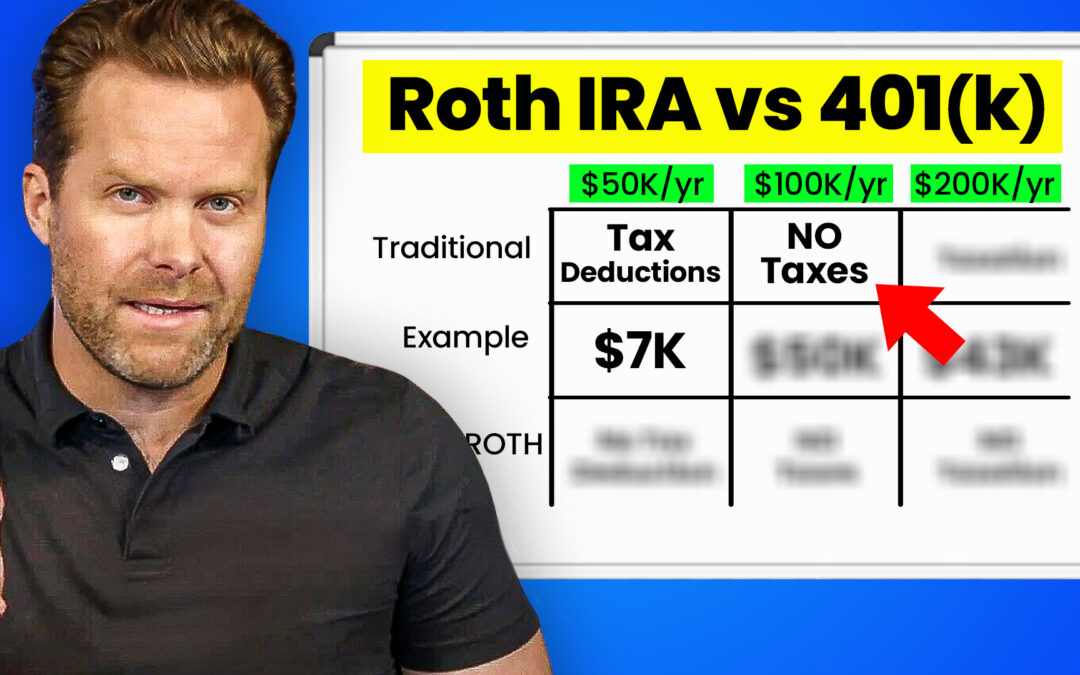

Ep.138 – Roth IRA vs 401(k)…where should You INVEST based on Your Salary Range

Discover the best investment strategy for your salary range in this detailed comparison of Roth IRA vs 401(k). Learn how to maximize benefits with free money matches, understand Solo 401(k)s, and make informed decisions about IRAs. Watch for essential retirement savings tips and get your Free Retirement Accounts Guide!

Ep.137 – My 2024 Roth Conversion: Why I Ignored the Calculators

Discover why Roth conversion is essential for long-term investments in our latest podcast episode. Learn why ignoring the calculators can benefit your 20 or 30-year investment strategy. Tune in now!

Ep.136 – The Complete Guide to Self-Directed IRAs: Top 10 FAQs Answered

In this episode, we tackle the top ten most frequently asked questions about self-directed IRAs. If you’re curious about investing your IRA in assets like real estate, private companies, crypto startups, or private funds, this episode is for you.

Ep.135 – Crowdfunding Real Estate: Inside a Self-Directed IRA or 401K

Today, we’re recording with Jamison Manwaring, co-founder of Neighborhood Ventures. We’ll discuss self-directed IRAs and real estate, leveraging IRAs and 401Ks for investments, and Neighborhood Ventures’ unique opportunities.

Ep.134 – Avoid THESE 5 Roth IRA Conversion Mistakes

In today’s video, I break down 5 common mistakes I see people make with Roth IRAs. Avoid these mistakes, or you’ll lose out on more money in retirement.

Ep.133 – The Benefits of Kids Roth IRAs and Teaching Financial Literacy

Join us in learning the benefits of Kids Roth IRAs and teaching children financial literacy through savings and investment. Discover why Kids Roth IRAs are ideal for college savings and retirement, the importance of earned income, and how to get started. We’ll provide practical tips and real-life examples to build a solid financial foundation.

![Ep.132 – Why do you need an IRA/LLC.. [everything you need to know]](https://directedira.com/wp-content/uploads/2024/05/IRA-LLC-Explained-1080x675.jpg)

Ep.132 – Why do you need an IRA/LLC.. [everything you need to know]

In this episode, Mat sheds light on IRA LLCs, potentially known as Checkbook Control IRAs. He breaks down the intricacies of this structure, highlighting its rules, potential pitfalls, and the power it has over a self-directed IRA and how our clients at Directed IRA stay successful with them.

Ep.131 – How to Actually RETIRE without needing Social Security (exact method)

In this episode, Mat Sorensen and Mark J Kohler discuss the looming crisis of Social Security running out and provide essential strategies for planning ahead. Learn how self-directing your IRA or 401k can serve as a powerful tool to safeguard your financial future amidst the potential loss of Social Security.