Directed IRA Articles

The #1 resource on self-directing your

IRA. Take control of your retirement™

Most Popular

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

2022 Solo 401(k) Contribution Deadlines: Rules, Steps, and Strategies

As 2022 has come to an end, it is critical that Solo 401(k) owners understand when and how to make their 2022 contributions. There are three important deadlines you must know if you have a Solo 401(k) or if you plan to set one up still for 2022. A Solo 401(k) is a...

Self-Directed IRA Versus Solo 401(k)

Many self-directed investors have the option of choosing between a self-directed IRA or a self-directed solo 401k. Both accounts can be self-directed so that you can invest in any investment allowed by law such as real estate, LLCs, precious metals, or private company...

Stuck With a 401K Loan and Leaving Your Job

Have you taken a loan from your employer 401(k) plan and plan on leaving? Unfortunately, most company plans will require you to repay the loan within 60 days, or they will distribute the amount outstanding on the loan from your 401(k) account. Its one of the ways they...

Can I Use a SEP IRA If I Have Employees?

A SEP IRA is a powerful retirement account used by many self-employed persons and business owners. It is particularly attractive as you can contribute up to $61,000 into it annually. That's in comparison to a Traditional IRA, where you can only contribute up to $6,000...

Solo 401K Form 5500 Tax Filing and Five-Point Compliance Checklist

Solo 401(k)s have become a popular retirement plan option for self-employed persons. These plans put the business owner in control of the plan but with that control also comes responsibility. Unfortunately, many solo 401(k) plans are not...

New Secure 2.0 Bill Fixes IRA Prohibited Transaction Penalty & Adds More Roth Dollar Options

There’s some good news coming out of Washington last week and that’s Secure 2.0. This new bill is full of new benefits and options for IRA and 401k investors.

2021 Tax Reporting for Your Self-Directed IRA

Self-Directed IRA investors must be aware of their self-directed IRA tax reporting responsibilities. Some of these items are completed by your IRA custodian and others are the IRA owner’s sole responsibility. Here’s a quick summary of what should be reported to the IRS each year for your self-directed IRA. Make sure you know how these items are coordinated on your account as the ultimate authority and responsible tax person on the account is, you, the account owner.

2021 Solo 401(k) Contribution Deadlines: Rules, Steps, and Strategies

As 2021 has come to an end, it is critical that Solo 401(k) owners understand when and how to make their 2021 contributions. There are three important deadlines you must know if you have a Solo 401(k) or if you plan to set one up still for 2021. A Solo 401(k) is a...

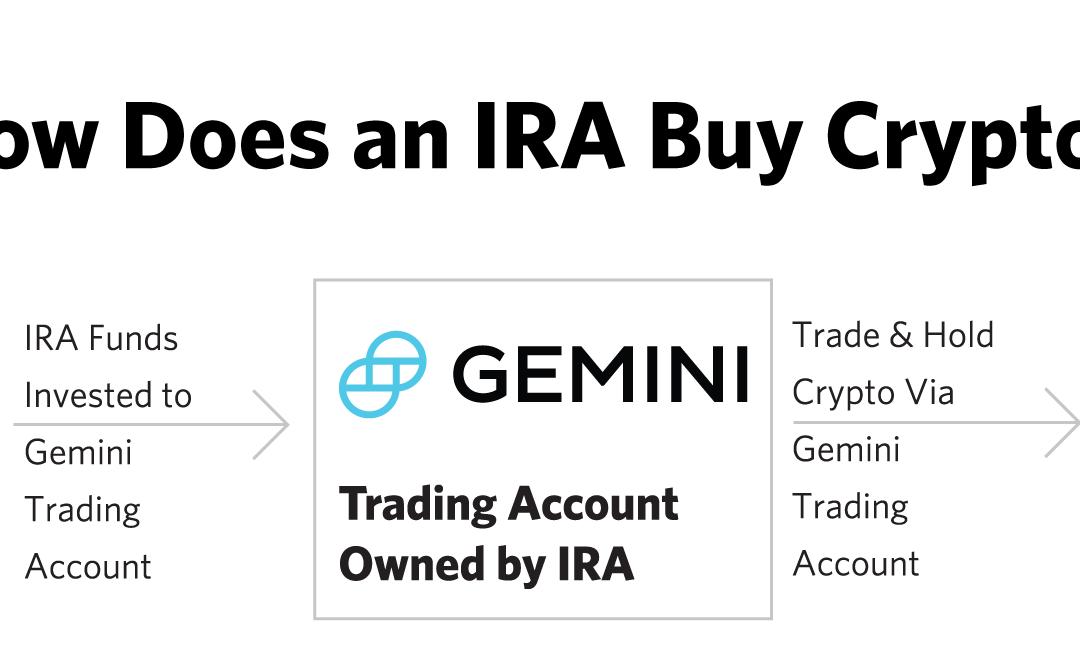

Buying Crypto with an IRA

By using a Roth IRA, an investor can purchase and sell crypto tax-free. Personal Crypto Accounts vs. Roth IRAs as Crypto Retirement Accounts The difference in taxation between personal crypto gains and crypto Roth IRA gains is significant. Say you bought...

Directed IRA Customers Invested Over $40M in Gemini Crypto IRA Solution in First 5 Months

Many investors and financial professionals are familiar with the primary benefits of a Roth IRA: that the plan’s investments grow tax-free and come out tax-free. But if tax-free investing isn’t enough to get you excited, rest assured, there are more benefits to the Roth IRA.

Subscribe to our Newsletter

Be the first to know when we release our latest articles, podcasts and videos

Most Popular

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.