by Mat Sorensen | Oct 4, 2023 | Blog

What is a Roth IRA? A Roth IRA is a savings vehicle designed to motivate us to save for retirement. You might be asking yourself, how are we motivated to save for retirement with a single account”? The Answer = TAX BENEFITS! A Roth IRA receives taxed contributions, so...

by Mat Sorensen | Sep 26, 2023 | Blog

So, you’ve decided to commit to a Roth conversion. There are a few things to know before you begin submitting your requests to your current custodian. There is a right way and a right time to do a Roth conversion. When you decide to do a conversion, you want to do it...

by Mat Sorensen | Aug 30, 2023 | Blog

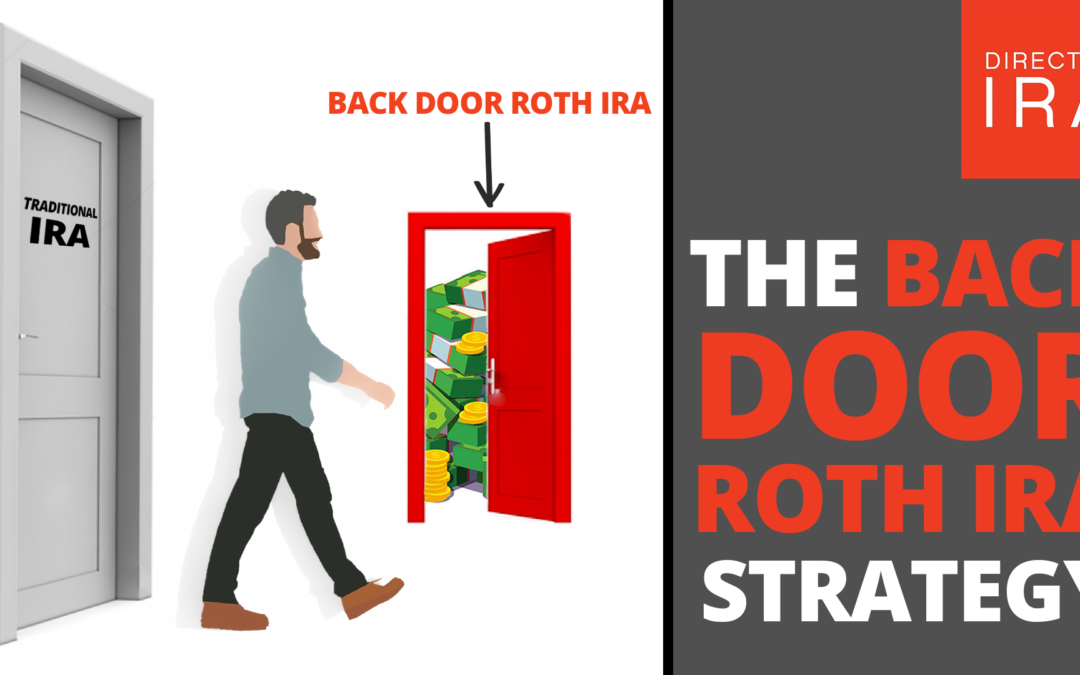

Do you make too much money to contribute to a Roth IRA? If so, the “backdoor” Roth IRA strategy is one of the best loopholes in the tax code you could utilize today. Many high-income earners believe they can’t contribute to a Roth IRA because they make too much money....

by Mat Sorensen | Feb 15, 2023 | Blog

My article on IRA/LLCs for self-directed IRA investors was published by the California Lawyers Association, Section on Business Law, eBulletin. In the article, I outline the benefits of an IRA/LLC, how to properly set up an IRA/LLC, how the documents need to be...

by Mat Sorensen | Jan 11, 2023 | Blog

As 2022 has come to an end, it is critical that Solo 401(k) owners understand when and how to make their 2022 contributions. There are three important deadlines you must know if you have a Solo 401(k) or if you plan to set one up still for 2022. A Solo 401(k) is a...

by Mat Sorensen | Oct 6, 2022 | Blog

Many self-directed investors have the option of choosing between a self-directed IRA or a self-directed solo 401k. Both accounts can be self-directed so that you can invest in any investment allowed by law such as real estate, LLCs, precious metals, or private company...