Using an IRA/LLC

(aka, checkbook IRA)

Self-Direct Your IRA. Invest in What You Know.

Take Control of Your Retirement™.

4 Key Points To Consider

When Using an IRA/LLC

1: Checkbook Control

2: Asset Protection

3: No Tax Return

If one IRA owns the LLC 100% there is no tax return required by the IRS. If the LLC has more than one owner the LLC files a partnership tax return.

4: Manager of the IRA/LLC

IRA/LLC Information In-Take Form+

For current Directed IRA account holders.

If you do not have an account please complete one of the applications below.

Resources On Using an IRA/LLC

aka Checkbook Control IRA

IRA/LLCs – IRA Ownership of LLCs

In the article, I outline the benefits of an IRA/LLC, how to properly set up an IRA/LLC, how the documents need to be restrictive over and above a standard LLC set up, and discuss the cases where self-directed IRA owners have improperly operated the IRA/LLC…

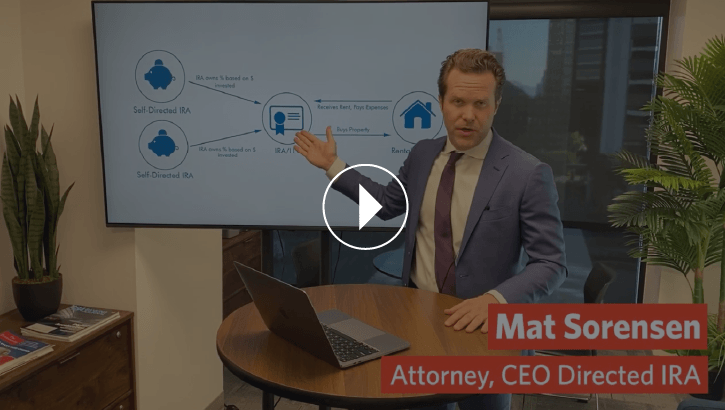

What is a Multi-Member IRA/LLC?

The Multi-Member IRA/LLC is the structure to use when you want to partner multiple accounts into one LLC to buy a particular asset or sets of assets. It can be a great option to partner with multiple accounts. What are the benefits, structures, concerns, and prohibited transaction rules you need to look out for?

IRA Ownership of an LLC: Self-Directed IRAs and IRA/LLCs

There are numerous laws, cases, and regulations to consider in analyzing whether your IRA can own an LLC (commonly referred to as an “IRA/LLC” or a “checkbook control IRA”)…..

New Case Answers Important Questions About IRA/LLCs

Can my IRA own substantially all of the ownership of an LLC? Can my IRA/LLC pay a salary to me for serving as the manager…

What Not To Do With Your IRA/LLC or Checkbook Control IRA: Niemann v. Commissioner

The recent case of Niemann v. Commissioner involves a successful real estate investor who unknowingly…

Episode 4: How to Use an IRA/LLC or Checkbook IRA

Join Mat and Mark as they break down how to set up the perfect structure to partner your IRA with other accounts or other individuals and build a mega IRA account….