Welcome to the

Directed IRA Learn Page

The #1 education source on self-directing your

IRAs and take control of your retirement™

Podcast

A show dedicated to educating and informing self-directed IRA and 401(k) investors on strategies, investments, legal structures, tax rules, and pitfalls. Hosted by tax lawyers Mat Sorensen and Mark Kohler who are also co-founders of Directed IRA & Directed Trust Company.

Articles

Videos

FREE Quick Start Guides

Latest

Contribution Deadline for IRAs and More Changed to May 17th

What is the last day to contribute to an IRA for 2020? Taxpayers now have until May 17, 2021, to contribute to their Individual Retirement Accounts (IRAs), Health Savings Accounts (HSAs), and Coverdell Education Savings Accounts (ESAs), according to a statement by the...

EP 17 – When Does Your IRA Have to Pay Taxes? UBIT and UDFI Explained

Mat and Mark outline how you can invest in Bitcoin and other Cryptocurrency with an IRA or 401k. They go over the three strategies available which can all be accomplished at Directed IRA. 1. Having your IRA directly own a crypto trading account at Gemini through our special strategic relationship (no IRA/LLC required). 2. Using an IRA/LLC where the LLC bank checking account is linked to a wallet/exchange of your choice. 3. Buying Bitcoin Trusts or ETF (Grayscale/Osprey). They also discuss tax benefits of using a retirement account, cold storage options, and fees to expect in the process.

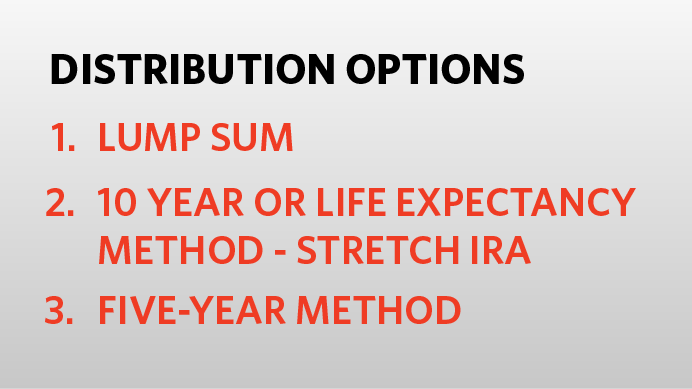

Inherited IRAs: Requirements and Tips

If you’ve inherited an IRA from a parent or another loved one, it is likely that you have an Inherited IRA (aka, Beneficiary IRA). These can be powerful accounts, but you need to understand the Required Minimum Distribution (“RMD”) rules for your Inherited IRA to...

EP 16 – How to Invest in Bitcoin and Other Cryptocurrency with a Self-Directed IRA or 401k

Mat and Mark outline how you can invest in Bitcoin and other Cryptocurrency with an IRA or 401k. They go over the three strategies available which can all be accomplished at Directed IRA. 1. Having your IRA directly own a crypto trading account at Gemini through our special strategic relationship (no IRA/LLC required). 2. Using an IRA/LLC where the LLC bank checking account is linked to a wallet/exchange of your choice. 3. Buying Bitcoin Trusts or ETF (Grayscale/Osprey). They also discuss tax benefits of using a retirement account, cold storage options, and fees to expect in the process.