Welcome to the

Directed IRA Learn Page

The #1 education source on self-directing your

IRAs and take control of your retirement™

Podcast

A show dedicated to educating and informing self-directed IRA and 401(k) investors on strategies, investments, legal structures, tax rules, and pitfalls. Hosted by tax lawyers Mat Sorensen and Mark Kohler who are also co-founders of Directed IRA & Directed Trust Company.

Articles

Videos

FREE Quick Start Guides

Latest

College Savings Account: Coverdell Education Savings Account (CESA) vs. 529 Plan

COVERDELL ESA Kids are going back to school after the break and it’s a great time to think about college and to make financial plans for your children or grandchildren’s education. As you consider the different plan options, you’ll want to make sure you know the two...

Can I Use a SEP IRA If I Have Employees?

A SEP IRA is a powerful retirement account used by many self-employed persons and business owners. It is particularly attractive as you can contribute up to $58,000 to it annually. That’s in comparison to a Traditional IRA, where you can only contribute up to $6,000 a...

Three Unique Benefits of Health Savings Accounts You Never Knew

HSAs (“Health Savings Accounts”) are growing in popularity as Americans are discovering significant tax savings with these accounts. Why are they popular? There are many reasons why; some well known and others not so well known. Let’s start with the primary benefits...

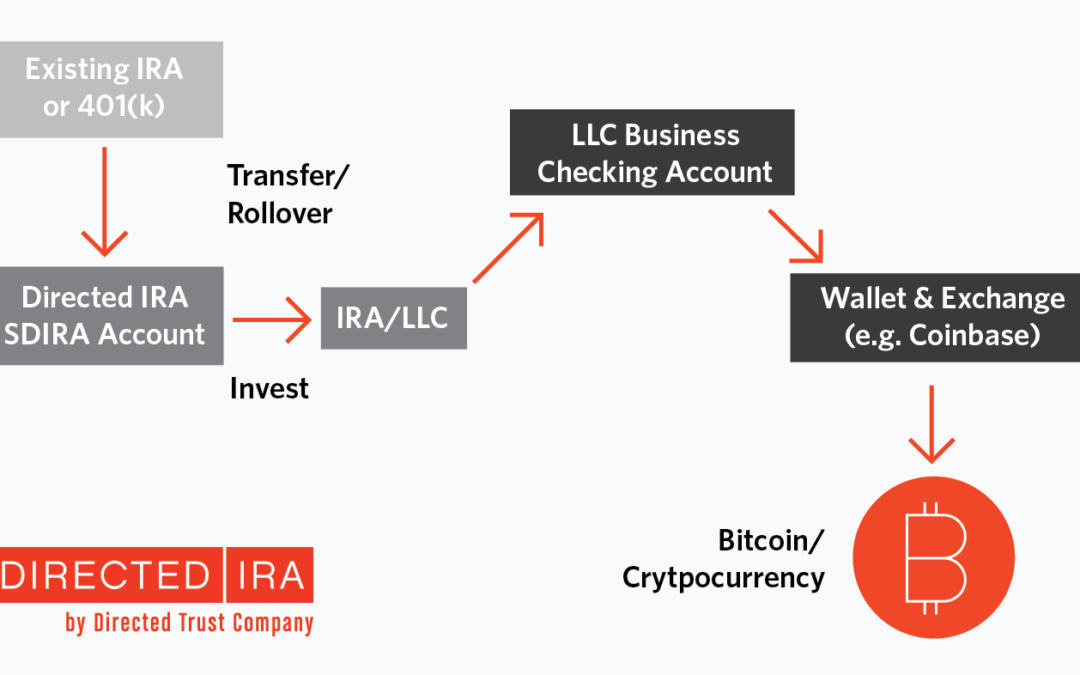

Using the IRA/LLC option to own Bitcoin and other Cryptocurrency

As the price of Bitcoin (BTC) has surpassed $50,000, we have seen increased interest in using IRA and other retirement plan funds to own Bitcoin and other cryptocurrencies. But can your IRA, Roth IRA, solo(k), or other retirement account own Cryptocurrency? Yes, your...