by Mat Sorensen | May 25, 2021 | Blog

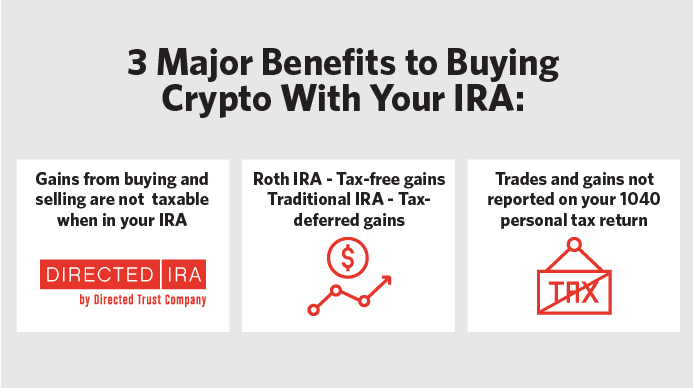

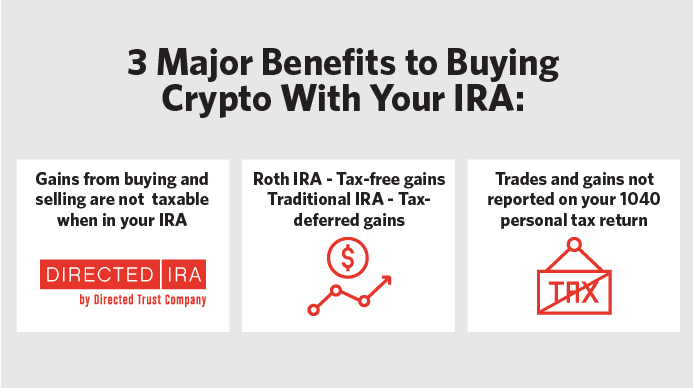

Avoid taxes and the headache of reporting to the IRS by buying crypto with your IRA. There are 3 major benefits to buying Crypto with your IRA: The gains from buying and selling crypto are not taxable when done in your IRA. Similar to buying and selling stock in your...

by Mat Sorensen | Mar 30, 2021 | Blog

What is the last day to contribute to an IRA for 2020? Taxpayers now have until May 17, 2021, to contribute to their Individual Retirement Accounts (IRAs), Health Savings Accounts (HSAs), and Coverdell Education Savings Accounts (ESAs), according to a statement by the...

by Mat Sorensen | Mar 12, 2021 | Blog

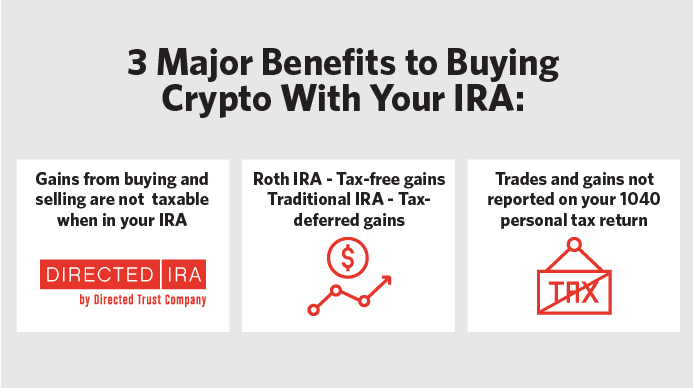

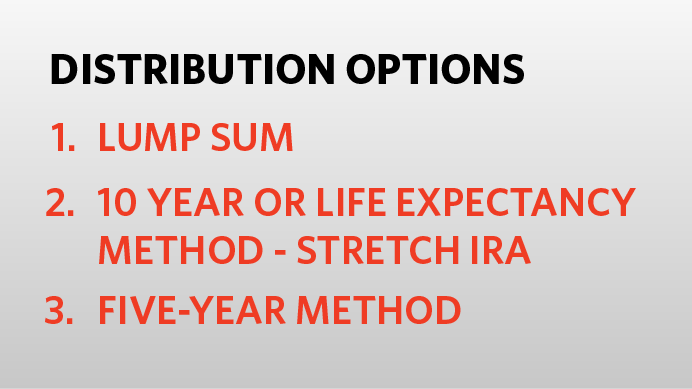

If you’ve inherited an IRA from a parent or another loved one, it is likely that you have an Inherited IRA (aka, Beneficiary IRA). These can be powerful accounts, but you need to understand the Required Minimum Distribution (“RMD”) rules for your Inherited IRA to...

by Mat Sorensen | Jan 26, 2021 | Blog

When IRA-owned property is held for rent, the management of the rental property must be structured such that rental income is received by the IRA and expenses are paid by the IRA. The IRA owner and other disqualified persons (e.g. IRA owner, spouse, etc.) cannot...

by Mat Sorensen | Jan 15, 2021 | Blog

COVERDELL ESA Kids are going back to school after the break and it’s a great time to think about college and to make financial plans for your children or grandchildren’s education. As you consider the different plan options, you’ll want to make sure you know the two...

by Mat Sorensen | Jan 8, 2021 | Blog

A SEP IRA is a powerful retirement account used by many self-employed persons and business owners. It is particularly attractive as you can contribute up to $58,000 to it annually. That’s in comparison to a Traditional IRA, where you can only contribute up to $6,000 a...